Innovative financing models for renewable energy projects in the European Union

Innovative financing models for renewable energy projects in the European Union

The European Union (EU) has set ambitious targets for renewable energy production, aiming to achieve a 32% share of renewable energy in its energy mix by 2030. To reach this goal, innovative financing models and funding opportunities are essential for the development and implementation of renewable energy projects. In this article, we explore various financing models and funding opportunities available for renewable energy projects in the EU, and how they can benefit industrial entrepreneurs.

Heat pump 10kW BLAUPUNKT BLP10P3V1M monoblock

JA Solar JAM54D40 450/LB Mono Bifacial High Perfomance Black Frame

Public-Private Partnerships (PPPs)

Public-Private Partnerships (PPPs)

One of the most popular financing models for renewable energy projects in the EU is the Public-Private Partnership (PPP). PPPs involve collaboration between public authorities and private sector entities, combining the strengths of both sectors to develop, finance, and operate renewable energy projects. The public sector provides regulatory support, land, and infrastructure, while the private sector brings in capital, technology, and expertise. This model has been successful in attracting investments and accelerating the deployment of renewable energy projects across the EU. For industrial entrepreneurs, PPPs offer a lower risk profile, access to public funding, and a stable regulatory environment.

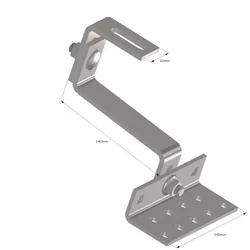

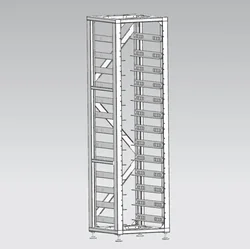

VARIO roof hook for Photovoltaics with double adjustment 140mm thick 1.4016

Sungrow SG10RT (3P, 2MPPT, Wifi) inverter

DEYE HV Energy Storage Battery GB-L 4.09kWh (High Voltage)

JinkoSolar photovoltaic module JKM575N-72HL4-BDV 575W Silver

DIN square nut 557 M8 for stainless steel clamps / profiles A2 AISI304 keyway

Green Bonds

Green Bonds

Green bonds are another innovative financing model that has gained traction inthe renewable energy sector. These bonds are issued by governments, financial institutions, or corporations to finance environmentally friendly projects, including renewable energy. The proceeds from green bonds are earmarked for projects that have a positive environmental impact, ensuring that the funds are used responsibly. Green bonds have become an attractive investment option for investors seeking to align their portfolios with sustainable development goals. For industrial entrepreneurs, green bonds offer a way to access capital for renewable energy projects while showcasing their commitment to sustainability.

Tigo TS4-A-O power optimizer (for modules with maximum power 700 W)1500V

Solar Edge SE33.3K-RW00IBNM4

Special Bi-Metal M6x25 self-tapping screw for trapezoidal bridges

GROWATT Off-grid inverter SPF 6000ES PLUS, 48VDC MPPT 100A, WiFi

Photovoltaic module PV panel 435Wp Longi Solar LR5-54HTH-435M Hi-MO 6 Explorer Black Frame Black frame

Crowdfunding and Peer-to-Peer Lending

Crowdfunding and Peer-to-Peer Lending

Crowdfunding and peer-to-peer (P2P) lending platforms have emerged as alternative financing models for renewable energy projects. These platforms enable individuals and organizations to invest directly in renewable energy projects, bypassing traditional financial intermediaries. Crowdfunding campaigns can be donation-based, reward-based, or equity-based, allowing project developers to raise funds from a diverse pool of investors. P2P lending platforms, on the other hand, facilitate loans between individuals or businesses, offering competitive interest rates and flexible repayment terms. For industrial entrepreneurs, these platforms provide an opportunity to tap into a new source of funding and engage with a community of environmentally conscious investors.

JA Solar JAM54D41 445/LB 445W High Efficiency Mono Bifacial Full Black (Container)

Hymon Heat Pump RSV-15AS/C 15KW monoblock

Double-threaded screw M10x200 for rafters DOUBLE-THREAD 10*200 complete with nuts and EPDM

Jinko Tiger Neo N-Type JKM445N-54HL4R-V (445 W, Black Frame)

EU Funding Opportunities

EU Funding Opportunities

The European Union offers various funding opportunities for renewable energy projects,including grants, loans, and guarantees. Some of the key funding programs include the European Regional Development Fund (ERDF), the Cohesion Fund, and the Horizon Europe program. The ERDF and Cohesion Fund support regional development and economic cohesion, with a focus on promoting renewable energy and energy efficiency projects. Horizon Europe, the EU's flagship research and innovation program, provides funding for projects that contribute to the EU's climate and energy goals. Industrial entrepreneurs can benefit from these funding opportunities by accessing financial support, technical assistance, and networking opportunities.

In conclusion, innovative financing models and funding opportunities play a crucial role in driving the growth of renewable energy projects in the European Union. Public-Private Partnerships, green bonds, crowdfunding, peer-to-peer lending, and EU funding programs offer industrial entrepreneurs various avenues to secure financing for their renewable energy projects. By leveraging these models and opportunities, entrepreneurs can contribute to the EU's ambitious renewable energy targets while promoting sustainable development and creating a greener future.