Innovative financing models for renewable energy projects in the European Union

Innovative financing models for renewable energy projects in the European Union

The European Union (EU) has set ambitious targets for renewable energy production, aiming to achieve a 32% share of renewable energy in its energy mix by 2030. To reach this goal, innovative financing models and funding opportunities are essential for the development and implementation of renewable energy projects. In this article, we explore various financing models and funding opportunities available for renewable energy projects in the EU, and how they can benefit industrial entrepreneurs.

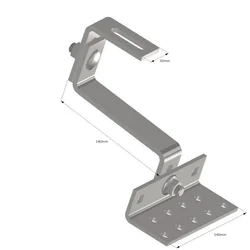

VARIO jumta āķis fotoelementiem ar dubultu regulēšanu 140mm biezums 1.4016

Public-Private Partnerships (PPPs)

Public-Private Partnerships (PPPs)

One of the most popular financing models for renewable energy projects in the EU is the Public-Private Partnership (PPP). PPPs involve collaboration between public authorities and private sector entities, combining the strengths of both sectors to develop, finance, and operate renewable energy projects. The public sector provides regulatory support, land, and infrastructure, while the private sector brings in capital, technology, and expertise. This model has been successful in attracting investments and accelerating the deployment of renewable energy projects across the EU. For industrial entrepreneurs, PPPs offer a lower risk profile, access to public funding, and a stable regulatory environment.

Īpaša bimetāla M6x25 pašvītņojošā skrūve trapecveida tiltiem

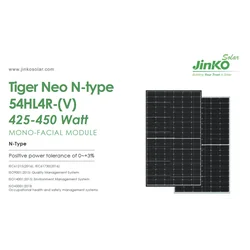

Jinko fotoelementu modulis 435W JKM435N-54HL4R-B 435W Full Black

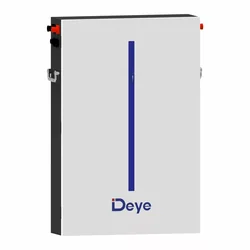

DEYE akumulators SE-G5.1-Pro-B 51.2V 100Ah 5.12kWh (zemspriegums)

Blaupunkt siltumsūknis BLP13P3V1M 13KW monobloks

Hibrīda invertors Deye SUN-12K-SG04LP3-EU | 12KW | Trīsfāzu | 2 MPPT | zemsprieguma akumulators

Fotoelementu modulis PV panelis 410Wp Risen RSM40-8-410M Mono, uz pusēm pārgriezts melns rāmis

Green Bonds

Green Bonds

Green bonds are another innovative financing model that has gained traction inthe renewable energy sector. These bonds are issued by governments, financial institutions, or corporations to finance environmentally friendly projects, including renewable energy. The proceeds from green bonds are earmarked for projects that have a positive environmental impact, ensuring that the funds are used responsibly. Green bonds have become an attractive investment option for investors seeking to align their portfolios with sustainable development goals. For industrial entrepreneurs, green bonds offer a way to access capital for renewable energy projects while showcasing their commitment to sustainability.

KRĀSAS SUN-25K-SG01HP3-EU-AM2 HIBRĪDA INVERTERA KRĀSAS 25 HV 3-FAZOWY

Jinko Solar fotoelementu modulis 435W 435 JKM435N-54HL4R-B FB Full Black

Siltumsūknis 7,5kW (nom. 8kW) Blaupunkt BLP08P1V1M monobloks

Crowdfunding and Peer-to-Peer Lending

Crowdfunding and Peer-to-Peer Lending

Crowdfunding and peer-to-peer (P2P) lending platforms have emerged as alternative financing models for renewable energy projects. These platforms enable individuals and organizations to invest directly in renewable energy projects, bypassing traditional financial intermediaries. Crowdfunding campaigns can be donation-based, reward-based, or equity-based, allowing project developers to raise funds from a diverse pool of investors. P2P lending platforms, on the other hand, facilitate loans between individuals or businesses, offering competitive interest rates and flexible repayment terms. For industrial entrepreneurs, these platforms provide an opportunity to tap into a new source of funding and engage with a community of environmentally conscious investors.

EU Funding Opportunities

EU Funding Opportunities

The European Union offers various funding opportunities for renewable energy projects,including grants, loans, and guarantees. Some of the key funding programs include the European Regional Development Fund (ERDF), the Cohesion Fund, and the Horizon Europe program. The ERDF and Cohesion Fund support regional development and economic cohesion, with a focus on promoting renewable energy and energy efficiency projects. Horizon Europe, the EU's flagship research and innovation program, provides funding for projects that contribute to the EU's climate and energy goals. Industrial entrepreneurs can benefit from these funding opportunities by accessing financial support, technical assistance, and networking opportunities.

Deye akumulators RW-M6.1-B 51.2V 120Ah 6.14kWh (zems spriegums)

DEYE Energy Storage HV akumulators BOS-G 5,12kWh (augstspriegums)

In conclusion, innovative financing models and funding opportunities play a crucial role in driving the growth of renewable energy projects in the European Union. Public-Private Partnerships, green bonds, crowdfunding, peer-to-peer lending, and EU funding programs offer industrial entrepreneurs various avenues to secure financing for their renewable energy projects. By leveraging these models and opportunities, entrepreneurs can contribute to the EU's ambitious renewable energy targets while promoting sustainable development and creating a greener future.